Financial Analysis of Serie A’s Northern Giants: Inter’s Key Revenue Lags Behind Juventus, AC Milan Has the Least Debt

Every autumn, Italy’s top football clubs publish their financial statements from the previous fiscal year, running from July 2023 to June 2024. Italian media outlet Calcio e Finanza recently analyzed the financial reports of Serie A’s northern heavyweights: Inter Milan, AC Milan, and Juventus. In short, Inter Milan shoulders the heaviest debt burden, while AC Milan experiences the least financial pressure. Let’s break down the numbers, starting with income comparisons.

Income Overview: Inter Leads in TV Rights, Trails in Sponsorship

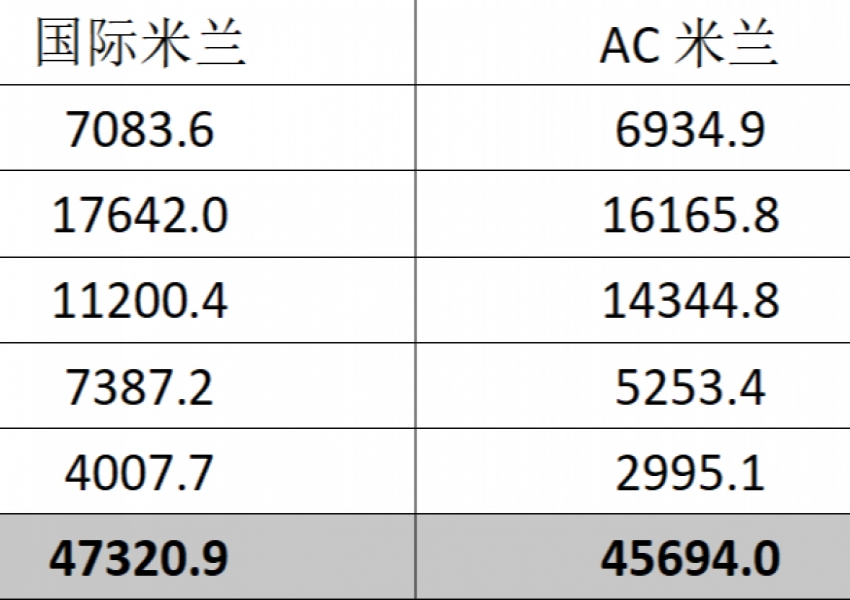

One of the primary sources of revenue for top football clubs is broadcasting fees, which include income from domestic league games, cup competitions, and European matches. Last season, Inter Milan secured €176 million from broadcasting rights, outpacing AC Milan and Juventus. This boost was mainly due to Juventus missing out on European competitions, significantly affecting their income. However, when it comes to commercial sponsorships, Inter lagged behind. Their sponsorship revenue was only €112 million, substantially lower than AC Milan’s €143 million and Juventus’s €160 million. As Inter’s new shirt sponsor deal takes effect this season, they hope to narrow this gap somewhat.

Another significant aspect of club revenue comes from "capital gains," which, in simplified terms, is the profit from selling players, minus their amortization cost. Inter excelled in this category, thanks to profitable sales like André Onana and Marcelo Brozović. Both players generated substantial transfer fees with minimal amortization costs. This boost in capital gains was crucial for Inter’s financial management.

Cost Analysis: Inter’s Personnel Costs in the Middle, AC Milan More Conservative

Examining expenditures, “personnel costs” are a major line item for clubs, encompassing salaries for players, coaching staff, and employees, along with taxes. Juventus leads in this category, spending €264 million, while Inter follows at €227 million. AC Milan, by comparison, has a more conservative payroll, totaling €188 million. This significant difference is a testament to Milan’s more cautious financial management.

Another major cost is “amortization and depreciation,” which refers to the annual amortization of transfer fees paid for players. Inter’s amortization cost stands at €121 million, lower than Juventus’s €169.9 million but higher than AC Milan’s €107.8 million. Despite being below Juventus’s figures, Inter’s overall costs still surpass those of AC Milan, reflecting a need to carefully manage their budget.

From a historical perspective, Juventus’s cost-cutting efforts have been notable. During the 2020-21 season, their annual expenses exceeded €700 million. Since then, they have reduced costs by 18.6%, showcasing a clear effort to streamline finances. On the other hand, AC Milan’s costs have increased since their recent championship season. Meanwhile, Inter's expenses have remained relatively stable over the past two seasons. However, this stability is under threat, as several Inter players have signed contract extensions that include salary increases, suggesting that future costs could rise significantly.

Profit and Loss: Inter’s Deficit Shrinks, Juventus Still in Deep Trouble

Turning to profitability, Inter Milan has managed to reduce their deficit to €35.74 million. A major factor behind this loss is financial costs, primarily interest payments on debt. Inter’s financial expenses are the highest among the northern trio, while AC Milan has a distinct advantage in this area, incurring almost no financial costs. Juventus, however, saw their deficit balloon from €124 million in 2022-23 to €199 million. The primary reason for this is their absence from European competitions, which dealt a massive blow to their finances. Juventus is back in the Champions League this season, and there is widespread hope that they can halve their deficit. Even so, a €100 million loss would still be significant.

Juventus fans have taken to social media platforms like Twitter, expressing a mix of resignation and defiance. Comments range from “Losing €100 million or €1 billion doesn’t matter, as long as Exor keeps bailing us out” to more pragmatic takes. Indeed, Juventus’s parent company, Exor, has injected €900 million into the club over the past few years to keep it afloat. Without these bailouts, Juventus’s ongoing massive losses would have been unsustainable long ago. This financial backing is a unique advantage for Juventus, unmatched in Serie A. AC Milan and Inter, both backed by American investment groups, do not have the same safety net. For this reason, the Milan clubs cannot afford to ignore deficits and spend recklessly, knowing their ownership will not provide unlimited financial support.

Debt Levels: Inter’s Alarming Debt Load, Milan’s Relatively Secure Position

Analyzing debt, Inter Milan stands out with a staggering total debt of €734.8 million. The bulk of this is comprised of €400 million in bonds, which far exceeds AC Milan’s total debt of €324 million and Juventus’s €638.8 million. Inter’s debt situation is exacerbated when considering liquidity factors and financial liabilities. Their “civil net equity” is approximately negative €100 million, unlike AC Milan and Juventus, whose civil net equity remains positive.

Looking ahead, each of the northern giants faces its own financial challenges. For Inter Milan, the uncertainty surrounding their ownership is a significant concern. Their majority shareholder, Oaktree Capital, has yet to clarify their long-term intentions. Should the California-based fund decide against a long-term investment, Inter may face another change in ownership within the next 1-2 years. This instability, coupled with Inter’s high debt and substantial annual financial costs, places them in a precarious position. If a new majority shareholder were to adopt a frugal approach similar to Erick Thohir’s tenure, Inter could find themselves in dire financial straits.

Juventus’s main challenge lies in their ongoing efforts to cut costs and increase efficiency. This season, keeping their deficit within nine figures will require deep runs in both the Champions League and the Club World Cup. The club must continue to find ways to shrink their deficit in the coming years, or they will remain reliant on further capital injections from Exor. Even with cost-cutting measures, recurring losses of over €100 million annually are unsustainable without additional financial support from their parent company.

AC Milan appears to be in the best financial health among the three. Their financial liabilities are minimal, and they are the only club capable of achieving net profit under current conditions. The Rossoneri are committed to maintaining a balanced financial approach. However, they face a significant hurdle: their parent company, RedBird Capital, needs to repay a €700 million “vendor loan” to former owner Elliott by August 2025. While this debt is not directly owed by the AC Milan club but rather by RedBird Capital, any difficulties in repayment could still impact the club. This situation mirrors the case of Inter’s owner, Steven Zhang, and his loan obligations to Oaktree Capital, highlighting the interconnectedness of club and ownership finances.

In conclusion, while each club has its strengths and weaknesses, the financial landscape for Serie A’s northern giants remains fraught with challenges. Inter’s heavy debt and uncertain ownership, Juventus’s struggle to rein in massive deficits, and AC Milan’s looming loan repayment create a complex financial puzzle, where the outcomes will shape the future of Italian football's most storied clubs.

Copyright Statement:

Author: mrfootballer

Source: Mrfootballer

The copyright of this article belongs to the author. Reproduction is not allowed without permission.

Recommended Blog

- Serie A Round 11: AC Milan Faces Familiar Faces Again, Can Juventus Stop Conceding?

- Bundesliga Matchday 9: Leverkusen's Fatigue on Two Fronts, Bayern Facing a Grueling Test

- Inter Milan’s Looming Executive Overhaul: Behind-the-Scenes Rules and Six Years of Remarkable Service

- La Liga Matchday 11: Post-Messi and Ronaldo Era’s Strongest El Clásico Approaches, and How Much Will Girona Pay for Their Champions League Efforts?

- Inter Milan's Strategy to Cope with Left-Side Shortage: Shifting Resources from Right to Left

- Inter's Grueling Three-Week Stretch Approaches as Rotation Strategy Unveiled, With Three European Veterans Key to Inzaghi’s Plans

- Nostalgia, Gratitude, and Staying True: Barella Makes Inter Proud but Brings Complexities

- A-League Season Opener: Central Coast Mariners Aim to Reverse Slump, Auckland FC Eyes Fans' Hearts

- One of Serie A’s Best U23 Holding Midfielders: Can Asllani Turn It Around at Inter?

- Asian World Cup Qualifiers: China’s Home Advantage, Australia Content With Just Scoring

Hot Blog

- English Media: Manchester United Will Win Premier League Title in 2028! History Will Repeat Itself, Two Teams Serve as Inspirations

- 0-2 Double Defeat! China National Team Stuck at 6 Points: No More Direct World Cup Hopes, Two Crucial Matches Ahead

- 4 AM Showdown: Barcelona's Revenge Match! Win = 3-Point Lead Over Real Madrid, Key Players Rested

- China National Football Team Drops 13.6 Points, Slips to 94th in FIFA Rankings: Syria Overtakes, New 9-Year Low

- 0-0 Draw! Japan 12 Shots, 2 Missed One-on-Ones: 8 Matches, 20 Points, Group Winner, Saudi Arabia Stuck at 10 Points in 3rd

- 4-1, Double Win Over Brazil! Argentina Celebrates: World Cup Qualification Secured, 4th Team Globally to Qualify

- Real Madrid Got Lazy: 7 Kilometers Less Running in UCL! Two Superstar Spectators While Barça Outruns Them All

- United Go for Glory: Unbeaten in 10, Fueled by Kobbie Mainoo’s Return, Red Devils Eye Europa League Crown

- Champions League Classic: Barça’s Midfield Maestro Worshipped by Thousands After 11.5KM Marathon

- Champions League Semifinal Odds: Barça at 99%, Real Madrid’s Hopes Dwindle to 6%, PSG Cruise Ahead